nebraska property tax calculator

There are no local income taxes in. The average salary for.

The Nebraska Department of Revenue DOR has created a GovDelivery subscription category called Nebraska Income Tax Credit for School District Taxes Paid Nebraska Property Tax Incentive Act Click here to learn more about this free subscription service as well as sign up for automatic emails when DOR updates information about this program.

. Registration fee for commercial truck and truck tractors is based upon the gross vehicle weight of the vehicle. Sarpy County real estate taxes are levied in arrears. They are normally payable in 2021 by whoever owns the property in 2021 and not by the people who owned it in 2020.

The median property tax on a 10910000 house is 114555 in the United States. AP Nebraska taxpayers who want to claim an income tax credit for some of the property taxes they paid have a new tool to help them calculate what theyre owed. Counties in Nebraska collect an average of 176 of a propertys assesed fair market value as property tax per year.

This tax information is being made available for viewing and for payments via credit card. P the principal amount. The Nebraska tax calculator is updated for the 202223 tax year.

Registration fee for farm plated truck and truck tractors is based upon the gross vehicle. Form 458L Physicians Certification for Late Homestead Exemption Filing. The first thing you need to figure out is your Nebraska income tax rate.

If you would like more information about Nebraska Taxes Online please contact Joe Power at 888-550-5685. The nebraska state sales and use tax rate is 55. Application for Transfer of Nebraska Homestead Exemption.

County AssessorDeputy County Assessor Examination May 12 2022. The tool helps residents calculate the new refundable income tax credit available this year that allows taxpayers to claim a portion of. A convenience fee of 100 is included on all e-check payments.

The median property tax on a 10910000 house is 192016 in Nebraska. About Your Property Taxes. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in Lincoln County.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Nebraska local counties cities and special taxation districts. For example the 2020 taxes are levied at the end of 2020 and become due on the last day of December 2020.

2022 Reports and Opinions of the Property Tax Administrator. Nebraska income tax brackets range from 246 to 684Nebraska uses a progressive tax rate system meaning that higher levels of income are taxed at higher rates. If you buy the property in the middle of.

Nebraska Income Tax Calculator 2021. The NE Tax Calculator calculates Federal Taxes where applicable Medicare Pensions Plans FICA Etc allow for single joint and head of household filing in NES. Your lender likely lists interest rates as an annual figure so youll need to divide by 12 for each month of the year.

Nebraska launches new site to calculate property tax refund. The median property tax in Nebraska is 216400 per year for a home worth the median value of 12330000. Nebraska school district property tax look-up.

Its a progressive system which means that taxpayers who earn more pay higher taxes. 1500 - Registration fee for passenger and leased vehicles. This information only applies to the Countys General Fund agencies for Fiscal Year.

The Registration Fees are assessed. A convenience fee of 235 100 minimum is included on all payments. So if your.

There are four tax brackets in Nevada and they vary based on income level and filing status. Nebraska property tax calculator. The median property tax in douglas county nebraska is 2784 per year for a home worth the median value of 141400.

The Nebraska income tax calculator is designed to provide a salary example with salary deductions made in Nebraska. Simply input your current property value and find out where your County tax dollars go. I your monthly interest rate.

Nebraska transfer tax calculator. Nebraska is ranked number seventeen out of the fifty states in order of the average amount of property taxes collected. State tax officials and Gov.

If you make 70000 a year living in the region of Nebraska USA you will be taxed 11756. The median property tax on a 10910000 house is 114555 in the united states. For comparison the median home value in Nebraska is 12330000.

The state charges 375 for each increment and the county charges 55 which an be up to 75 as authorized by the county board of commissioners with a population more than 2000000 or more. Nebraskas state income tax system is similar to the federal system. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact your county or citys.

To show how your Lancaster County tax dollars are spent we have developed this calculator which breaks down your County taxes only by General Fund agency. Most taxpayers pay fall into the second and third tax brackets because of the average income made by Nebraskans. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

Pete Ricketts announced the new online service on Wednesday. The lowest tax rate is 246 and the highest is 684. Computing real estate transfer tax is done in increments of 500.

Motor Vehicle Tax Calculation Table MSRP Table for passenger cars vans motorcycles utility vehicles and light duty trucks wGVWR of 7 tons or less.

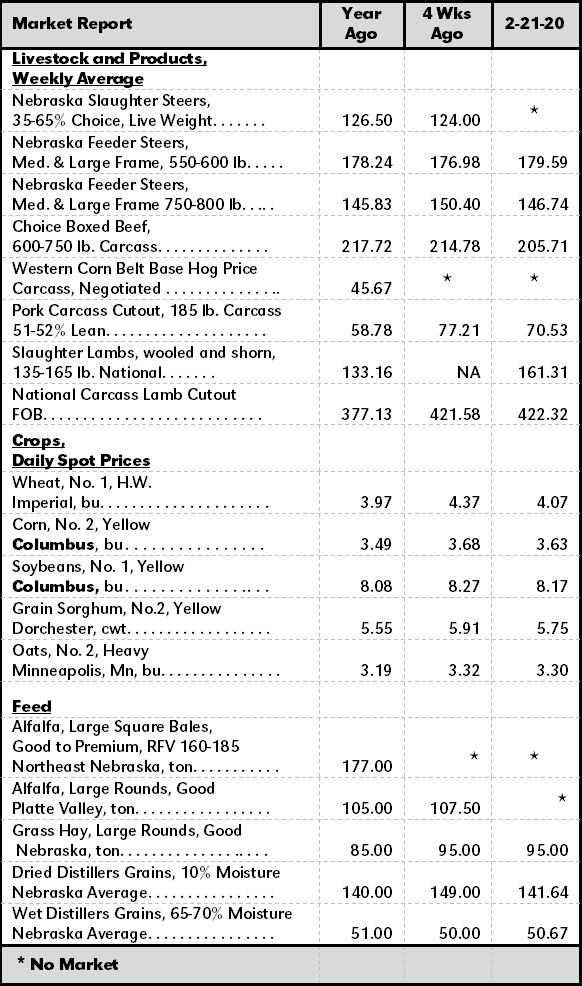

2020 Nebraska Property Tax Issues Agricultural Economics

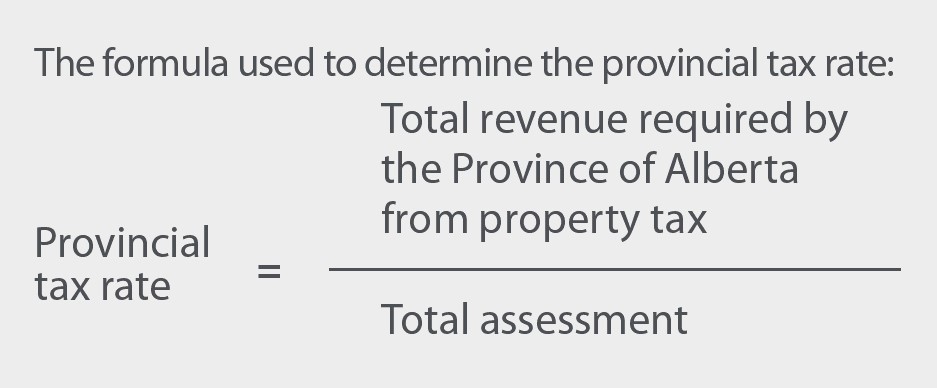

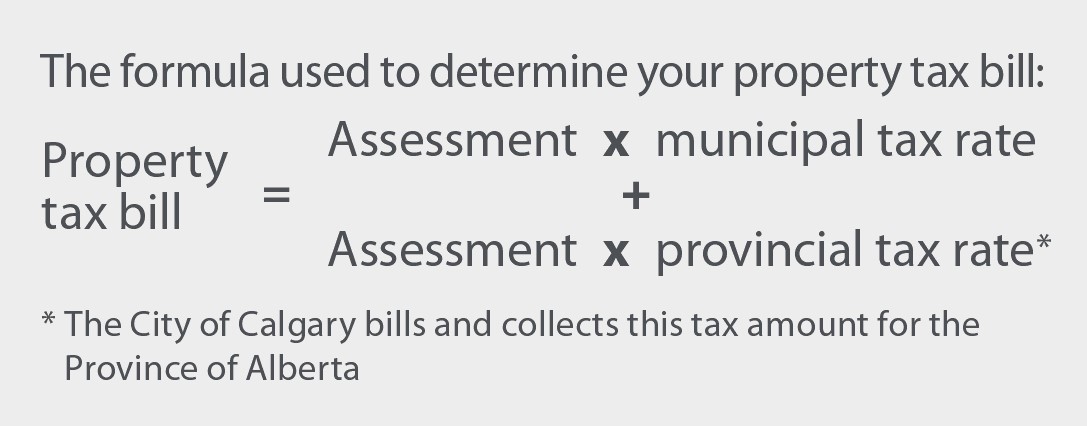

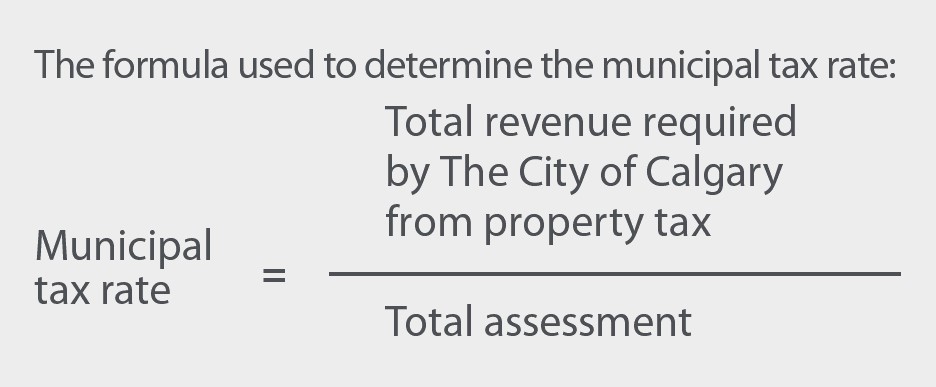

Property Tax Tax Rate And Bill Calculation

Property Tax Tax Rate And Bill Calculation

Realtor Real Estate In Uttam Nagar Agent Real Estate In Uttam Nagar Ne Facade Architecture Design Residential Building Design Architecture Building Design

Monday Map State Local Property Tax Collections Per Capita Property Tax Map Teaching Government

How To Calculate Basis Points Sapling Calculator Direct Marketing Things To Sell

Property Tax Tax Rate And Bill Calculation

02 W Hwy 27 Highway Property Tax Real Estate Mortgage Calculator

States With The Highest And Lowest Property Taxes Property Tax States Tax

Property In Uttam Nagar Property Near Metro Property Near Metro Station Property Ne Small House Front Design Small House Elevation Design House Front Design

States With The Highest And Lowest Property Taxes Social Studies Worksheets Property Tax Fun Facts

When We Reach Retirement Age A Lot Of Us Plan To Move To That Dream State We Always Pictured Ourselves Growing Old Gas Tax Healthcare Costs Better Healthcare

14863 Ogren Place Ne Otsego Mn 55330 Mls 5718731 Themlsonline Com Home Mortgage Construction Loans Property Prices

Property Tax How To Calculate Local Considerations

A New Map Courtesy Tax Foundation Shows Where Pennsylvania Stacks Up On State Gas Taxes For More On Transpor Infographic Map Safest Places To Travel Fun Facts

Capital Gain Exclusion Capital Gain Things To Sell Real Estate Tips